Majority of licensed coffee buyers in Kenya are not using the Nairobi Coffee Exchange. According to NCE Chairman Peter Gikonyo, the auction attracts an average of 25 buyers on each auction day.

“This low participation by buyers affects competition in bidding of coffee at the auction as this is where 80% of the Kenyan coffee is traded. Currently there are 121 licensed coffee buyers by Agriculture and Food Authority (AFA) for the season 2023/2024 but only 58 have registered at the NCE to buy from the auction. This is a major concern,” he quips.

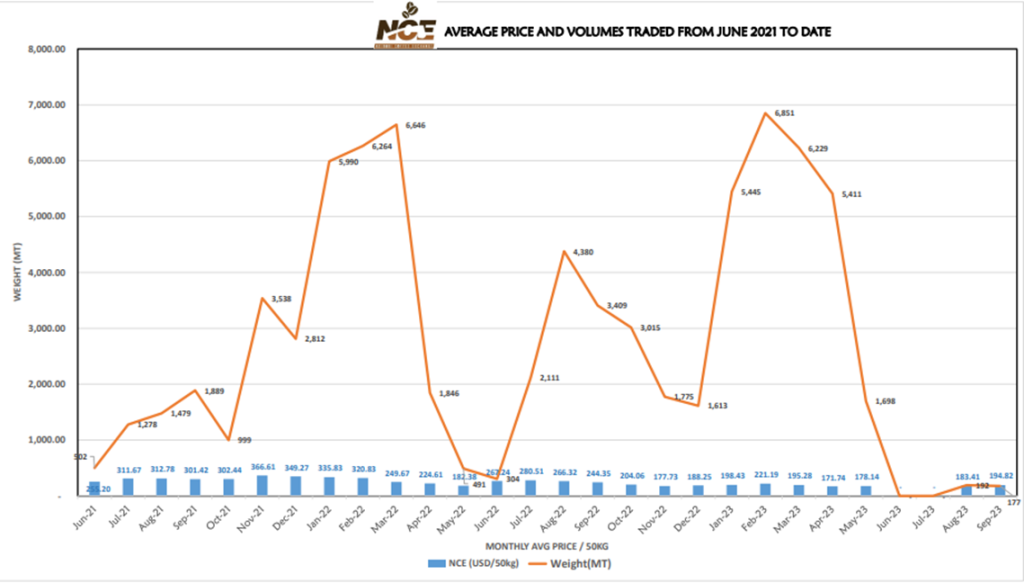

The auction has witnessed low prices in the ending season under review.

The auction volumes for August 2022 were at 4,380MT, compared to this August 2023 at 192MT representing a 95.62% drop of the volumes flowing to the trading floor. The Average price during August 2022 is 266.32 per 50kg bag, in August 2023, the average price is at a low of 183.41 per 50kg bag, also recording a 31.13% drop.

Gikonyo says the information shared by growers attests to this slow flow of volumes to the trading floor as most of the Coffee Parchment is in the custody of their contracted Millers who have not been able to secure milling licenses issued by the county governments. The previous licenses to the millers expired and the millers have to apply afresh.

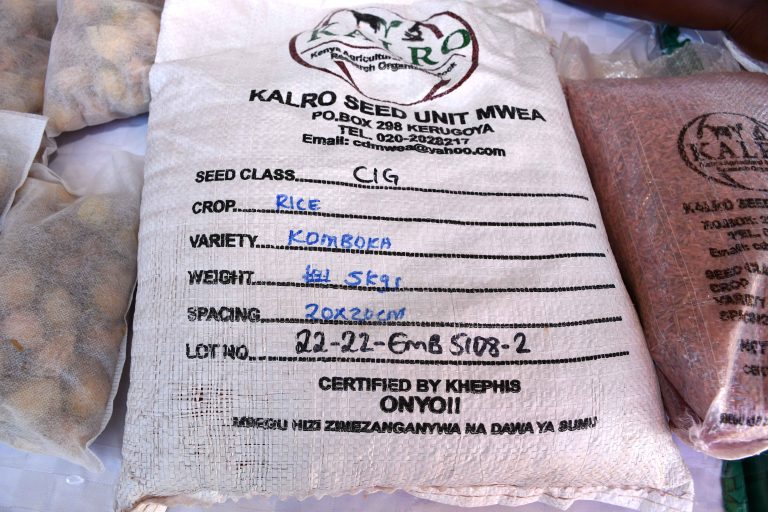

Photo by Kilimo News

As at the end of the coffee year 2021/22, the auction had 52 buyers participating against 122 coffee buyers licensed by AFA Coffee Directorate for the same period.

In the crop year 2021/22, auction sales stood at 630,646 full bags with the highest buyer (Ibero Kenya Ltd) purchasing about 24%. Other major buyers who featured included Kenyacof Ltd, Taylor Winch Ltd, C. Dorman Ltd, Mumbi Coffee Merchants Ltd, Star Coffee Ltd amongst other coffee traders.

- The value generated for the year went up by USD 86.1 million, from USD 141,240,377.46 in the previous year, 2020/2021 representing a 60.95%.

- Volumes traded also went up by 54.79% 407,432 full bags in the previous year.

The Chairman says this records the highest volumes the Exchange has traded over the last 10 years, which has in turn translated into better payment to the farmers.

Among the 9 top destinations whose total uptake of about 79.6%, only Tunisia and Norway do not belong to any major economic bloc. Countries such as Belgium, Germany, Sweden, and Denmark belong to the European Union (EU) which takes about 41.2%.

It is not surprising that none of the countries comprising South America common market is presently importing coffee from Kenya, the economic bloc includes among others Brazil and Colombia which are major world coffee producers.

Despite these hitches, Gikonyo says there has been positive developments at the exchange. NCE has a robust automated coffee auction system which was put in place in 1998 with an upgrade in 2018. Further in 2020 a web-based platform was acquired to enable trade participants to work remotely from their offices or homes in any part of the world. The digital upgrade is one of the successes NCE celebrates today as it has brought a lot of ease in the way coffee is traded. To enhance transparency and encourage growers to follow trading, regional screens were installed in various coffee producing regions i.e., Nyeri, Kirinyaga, Kisii, Bungoma, Machakos and Meru and farmers.

Further he adds that NCE is in the process of deploying a mobile app where growers can follow their trading as they go on with their daily life.

The appointment of NCE Management Committee in July 2022 – June 2023 by the Ministry of Agriculture through the Cabinet Secretary, has assisted in the implementation of key changes in line with the expectation of the Crops (Coffee) (General) Regulations 2019 and the Capital Markets (Coffee Exchange) Regulations 2020.

This includes but not limited to admission of Coffee Brokers to the trading floor, appointment of a Direct Settlement System service provider, and the development of the draft NCE Trading Rules 2023 in compliance with the Capital Markets Coffee Exchange Regulations 2020

This has now allowed the growers to participate in the auction through their own licensed organizations as they are no longer required to provide the 1 million USD Bank guarantee.

The nine-member committee has been re-appointed for another three (3) months to oversee the full implementation of the pending issues, which include, NCE Trading Rules, 2023 and the full operationalization of the Direct Settlement System (DSS)

The Direct Settlement System is a banking facility provided by Commercial Banks, regulated by the Central Bank of Kenya, for clearing and settling coffee sales proceeds. Currently, the Cooperative Bank of Kenya is the appointed service provider, with the key users including coffee growers, buyers, brokers, warehousemen, and millers.

“This will not only enhance transparency, efficiency and effectiveness of the trade but also improve the liquidity to growers as the coffee sales proceeds are settled directly to their US dollar account within the prompt date after the sale and no more money is held in the DSS system.

So far USD 663,228.73 for sale 30 and 31 have paid through the DSS successfully,” says Gikonyo.

Gikonyo adds that the implementation of the EU Deforestation regulations requires the grower GPS coordinates and the polygons to be embedded in the trading data to ascertain that coffee is not grown from land that was previously forest land. To this end NCE is currently developing traceability models, such as the Traceability System Module (TSM) and are collaborating with GIZ in the Digital Integration of Agricultural Supply Chains Alliance (DIASCA) project which will bring about data integration, ensuring interoperability among various digital solutions used in the coffee value chain significantly contributing to traceability and Transparency in the coffee value chain

According to Gikonyo, since quality control is essential in the coffee industry to ensure that the final product meets the desired standards, especially for specialty coffees that are known for their unique flavor profiles, the Exchange is looking to incorporate a coffee lab that will enhance grading, cupping, and supply chain transparency.

Gikonyo outlines several measures that could improve coffee trading at the NCE. These are

- Encourage all licensed buyers to participate at the auction to increase competition and potentially improve prices.

- Coffee growers need to improve the quality of their production to capture a larger share of the international market and thereby increase the much-needed foreign earnings from the sale of coffee.

- Growers to Embrace and enroll on Direct Settlement System to enhance seamless and transparent settlement of coffee sales proceeds.

- Improvement of the price discovery mechanism anchored on an independent Quality Analysis to coffee buyers and grower representatives. to bridge the gap existing between the buyer and the seller in reserve price setting regarding the cup quality and coffee grade with the prevailing market dynamics.

- Develop a more robust digital trading platform alongside the auction system to allow continues trading of coffee not limited to auction days with emphasis to specialty coffee.

- All to embrace coffee reforms and encourage the players to play their respective roles in ensuring business continuity. A major shift towards the reforms have been achieved and any deviation would disrupt the path to full implementation.