By Henry Kinyua

Welcome to this weeks’ edition of The HK Coffee Market Summary. Sale number 24

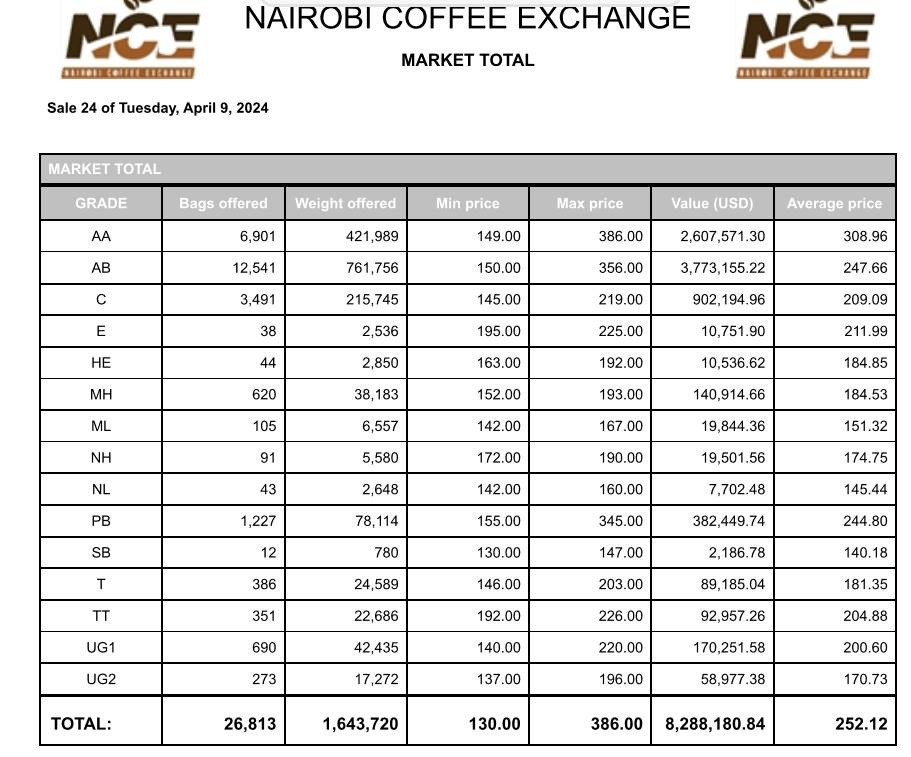

This week the rains seems to have retreated and Tuesday 9th April was rather a hot day and so was the coffee trading inside the NCE trading floor and online platforms. This week was the sale 24 of the 2023/2024 Coffee year.

In this sale, 26,813 bags or 1,643,720 kgs. of coffee were traded at the auction. The value of coffee traded was $8,288,180.84 or Kshs 1.1 B.

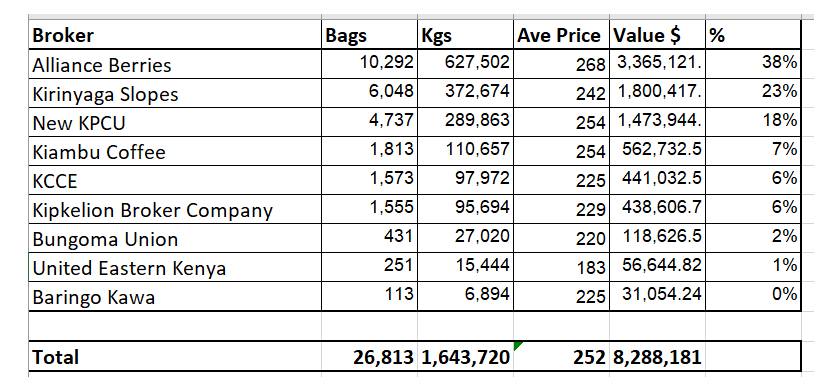

Brokers

The number of brokers selling coffee at the auction were nine. Alliance Berries traded the highest volume at 38% followed by Kirinyaga Slopes at 23%, New KPCU at 18%, and Kiambu Coffee Marketing at 7%. KCCE Marketing Agency Ltd and , Kipkelion Brokers Ltd traded at 6% each, Bungoma Union at 2% and United Eastern Kenya Coffee Marketing Company Ltd at 1%.

The highest price paid for coffee was $386 per a 50 kg bag or $ 7.7 per Kg. This is equivalent to about Kshs 154 per kilo of cherry at the trading floor. This lot of 107bags or 6,595 kgs. was from Karumandi Factory from Kirinyaga County and was sold by Alliance Berries and bought by Ibero Africa.

The Top grades AA and AB comprised 77% of the volume traded with the other balance taken by the lower grades introduced.

Rainforest Alliance (RFA) and Fair Trade (FLO) are the two certifications that coffee growers hold. In this sale, a total of 3,731 bags or 14% of volumes traded were from certified growers.

Coffee Buyers

A Total of 16 buyers participated at the auction. the top 7 buyers led by Kenyacof bought 95% of all the coffee presented at the auction. In the category of the least volume procured by a buyer, we had Rockbern Coffee Group Ltd buying 20 bags.

Status: Confirmed or Noted

The last column of the sales transaction listing released by NCE after every sale is STATUS that indicates if the lot traded was CONFIRMED or NOTED. Like in this sale 8, 0nly 112 bags 1% of volume traded were listed as confirmed.

To understand these terms lets look at the process of trading at the exchange as defined in the Capital Markets (Coffee Exchange) Regulations 2020 (see section attached below).

Before going to the market, the broker together with the grower or the coffee owner states their reserve price in the sales catalogue. This is the minimum amount they are willing to take for their coffee. The figure is known to the broker and grower but not disclosed to the buyers. If the price offered for each lot traded meets or surpasses the reserve price, the broker confirms the sale as complete. However, if the highest bidder falls short of the reserve price, the broker NOTES that price.

The broker then has 24 hours to consult both the grower and the buyer (mostly the highest bidder) to negotiate. They might agree a price different from what was offered and can confirm the sale. If they do not agree then the coffee is removed from the market and can be presented in the subsequent markets. It is important to note that the negotiation can only be with the highest bidder.