The tea sub-sector is one of the key drivers of Kenya’s socio-economic development, providing a source of livelihood to over 834,129 farmers and about 6.5 million Kenyans directly and indirectly which represents 13% of Kenya’s population. It contributes about 2% of Kenya’s GDP and 4% of the agriculture GDP. The sub-sector accounts for approximately 21% of the export earnings and is the third leading foreign exchange earner for the country after diaspora remittances and tourism. Globally, Kenya remains a key producer and the leading exporter of Black CTC tea accounting for 24% of the world tea exports. The sub-sector plays a major role in the infrastructural development of 20 tea growing counties thus underscoring the importance of the sub-sector in supporting, Vision 2030 and the Bottom-up Economic Transformation Agenda (BETA).

Key Reforms Highlights

To address the challenges facing sub-sector, the government has been implementing reforms in the past two years with a view to increase returns to tea growers and other tea value chain actors. Some of the key challenges that have been facing the sub-sector include:

1. Declining tea prices at the Mombasa auction leading to unsustainable earnings to tea growers;

2. Increasing levels of unsold tea stocks;

3. Declining quality of Kenyan tea;

4. Exploitation of tea farmers by middlemen through green leaf hawking malpractices;

5. Low levels of value addition and product diversification of Kenya tea;

6. Poor governance practices among the institutions managing the smallholder tea sector and Conflict of interest along the value chain;

7. Lack of transparency in price discovery and transmission mechanism at the tea auction

Key reforms currently under implementation include strategic tea quality improvement program, reducing the tea outlots quantities at the auction, addressing governance challenges facing the tea industry institutions, incentivizing tea value addition and product diversification, enhancing market access to new and emerging markets and reducing the costs of production borne by the tea farmers.

Key Milestones

The reforms being undertaken in the tea subsector have had the following impact:

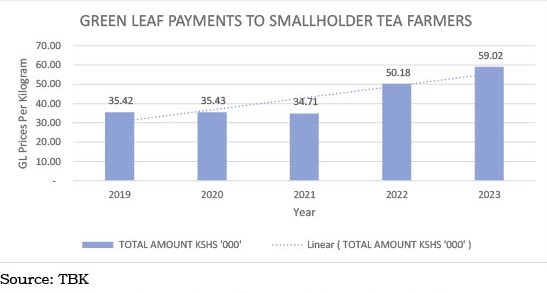

Payment to Tea Farmers

The reserve price and other factor have led to a rise in the earnings by tea farmers in the last 2 years. In 2022 and 2023, the total green leaf payment to tea famers increased by 45% and 70%, respectively to Kshs. 50.18 per Kg and Kshs. 59.02 from Kshs. 34.71 recorded in 2021. As a result, the total payout

to smallholder tea farmers increased from Kshs. 62.8 billion in 2022 to Kshs. 67.7 billion in 2023. An analysis of the green leaf prices for the last 5 years is given here below; –

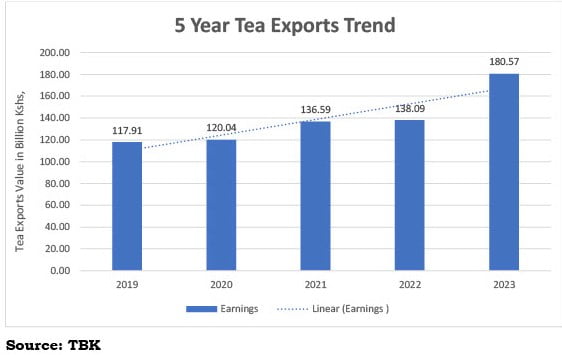

Export Earnings and Total Proceeds from the Sale of Tea

Export Earnings from tea has increased from Kshs. 136.59 billion in 2021 to Kshs. 138.09 billion in 2022 and Kshs. 180.57 billion in 2023.

During the 2023, a further Kshs. 16.4 billion was realized from the sale of tea in the domestic market thus making the total proceeds from the sale of tea to Kshs. 196.97 billion.

Fertilizer subsidy for Smallholder Tea Farmers

In the last two years close to a million farmers have greatly benefited from government subsidized fertilizer which have helped to increase their productivity and overall production. This year alone, over 834,129 smallholder tea farmers benefited from 97,974 metric tons of government subsidized fertilizer at a price of Kshs. 2,500 down from a market price of over Kshs. 7,000. From this consignment, 92,700 metric tons was procured and distributed the tea farmers under KTDA and 5,274 metric tons was procured and distributed through Kenya National Trading Corporation e voucher system.

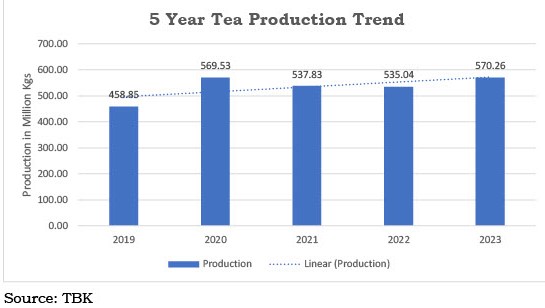

Tea Production

In the last 3 years, tea production has significantly increased from 458.85 million kgs in 2019 to 570.26 million in 2023. An analysis of the five-year tea production is given here below:

Governance in Smallholder Tea Factories

In the last 10 years, the smallholder tea sub-sector managed by KTDA has been facing operational and governance challenges thus affecting the performance of the sub-sector and earnings by tea growers. However, through the government-initiated reforms, all smallholder tea factories elected new board for their factories who are aligned to the reforms aimed at benefiting of tea growers. As a result, there has been great improvement in the governance structures, accountability and transparency within the management of the smallholder subsector tea factories in the last two years. Further, TBK has assisted the factories in developing new election guidelines aligned to the Companies Act, 2025 and the Tea Act, 2020.

In addition, TBK has developed corporate governance guidelines for the tea industry to guide in the management of institutions along the whole value chain. To reduce the operational costs borne by the tea farmers, TBK has assisted smallholder tea factories in signing reviewed management agreements which will see tea farmers save over Kshs. 1 billion costs from operation expenses and enhance their earnings. It is envisaged that adoption of these instruments will further enhance corporate governance in smallholder tea factories.

Tea Value addition

Value addition in tea has been prioritized under the Bottom-up Economic Transformation Agenda (Beta) as one of the key drivers to increasing the value of tea exports and returns to tea farmers. Towards this end, the government through the finance Act, 2023 removed VAT on all teas purchased from local tea factories for value addition prior to exportation. In addition, the National Treasury has also approved the concept note aimed at incentivizing tea value addition through the establishment of a Common User Facility (CUF) at Dongo Kundu Special Economic Zone among other interventions. Implementation of 11 interventions contained in the concept note will spur value addition in the country from the current 5% to over 50% by 2027.