By Kimuri Mwangi

The government is promoting the merger of small cooperative societies to enhance their competitiveness both locally and internationally.

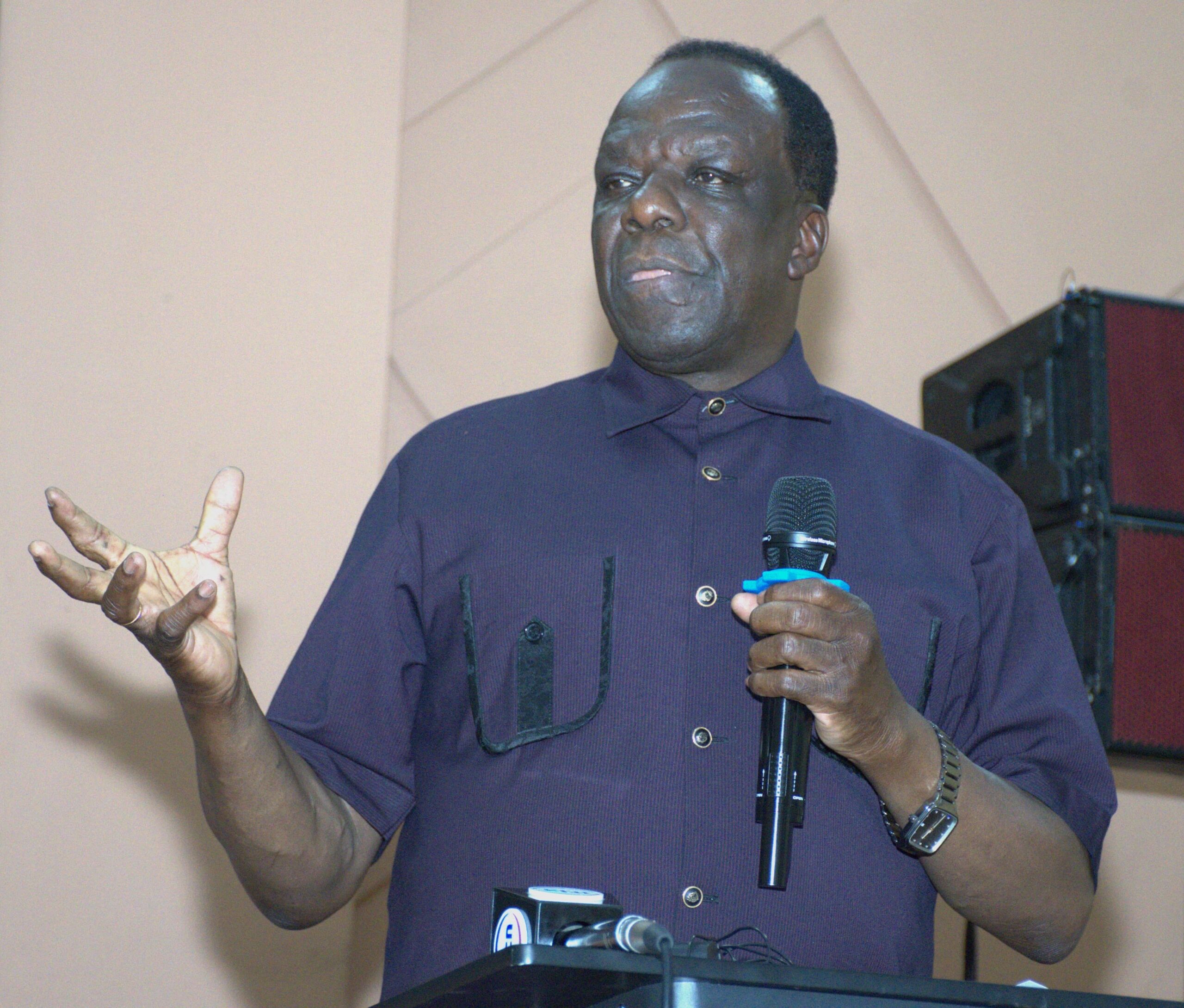

Cabinet Secretary for Cooperatives and MSMEs Wycliffe Oparanya stated that many small cooperatives are struggling to withstand emerging economic pressures, emphasising the need for new approaches to ensure their viability.

“We cannot ignore the realities facing the sector. Over 216 regulated SACCOs have asset bases below Sh1billion, limiting their ability to compete effectively,” he said during the 4th annual Cabinet Secretary’s Cooperative Movement Stakeholders’ Forum.

Oparanya urged Savings and Credit Cooperative Organizations (SACCOs) operating within similar economic or social bonds to consider mergers or shared services, especially ICT platforms, to achieve economies of scale, improve service delivery and remain competitive in a financial landscape increasingly shaped by fintech innovations.

“Global business practices demand entities to consolidate resources to enjoy economies of scale. Further, merging of small cooperatives, especially the SACCOs, will boost Kenya’s competitiveness in the global cooperative movement,” said Oparanya.

The CS noted that cooperative leaders must adopt international best practices that prioritize high returns, citing the success of cooperative giants in the United States, Canada and Europe.

“Giant credit unions in the USA, Canada, and other developed countries have continuously fast-tracked mergers and acquisitions but equally maximized on technology, thus being able to serve their customers within their jurisdictions,” he added.

He said a review of the legal framework may be necessary to streamline the merging process and curb the proliferation of new cooperative societies formed due to leadership disputes or resource mismanagement.

“We have long witnessed self-interested businesspeople seeking registration of new cooperative societies while other big institutions split due to leadership wrangles and resource mismanagement. The government’s new advocacy is that small cooperative societies need to embrace new ideas of operating compound businesses that can manage costs, compete aggressively, and enjoy economies of scale,” added the CS.

Oparanya further called on the movement to prioritize innovation and sustainability, stressing the importance of ICT adoption as competition intensifies from digital lenders and commercial banks.

“Shared digital platforms, fintech partnerships, and sound cybersecurity practices are no longer optional; they are critical for growth and resilience,” the CS said.

Cooperative Alliance of Kenya (CAK) chairman McCloud Malonza emphasized the need for accuracy and transparency in reporting, saying technology and consistency are essential.

He said outdated systems must be phased out to improve accountability.

“By doing this, we signal to our 14 million members, to the government, and to international partners that the data coming out of the Cooperative Movement is verifiable, reliable, and absolutely trustworthy,” Malonza said.

Malonza added that the cooperative movement remains strong and is well-positioned for further growth, both locally and internationally, thanks to reforms already undertaken.

“The future of Kenyan cooperatives is bright, but its path is demanding. We must lead with professional zeal, innovate with digital solutions, and govern with uncompromising integrity. As the CAK, we pledge our support to the necessary reforms to write the blueprint for the Cooperative Renaissance,” Malonza said.

According to the Department of Cooperatives, Kenya has 26,582 registered cooperatives, comprising 13,511 SACCOs and 4,300 SACCO agents. However, many operate on a small scale with limited assets and are unable to meet their expenses.

The cooperative movement remains a major contributor to Kenya’s economy. The regulated SACCO subsector recorded a total asset base of Sh1.07 trillion last year. Kenya ranks first in Africa in cooperative membership and deposits, and seventh globally.