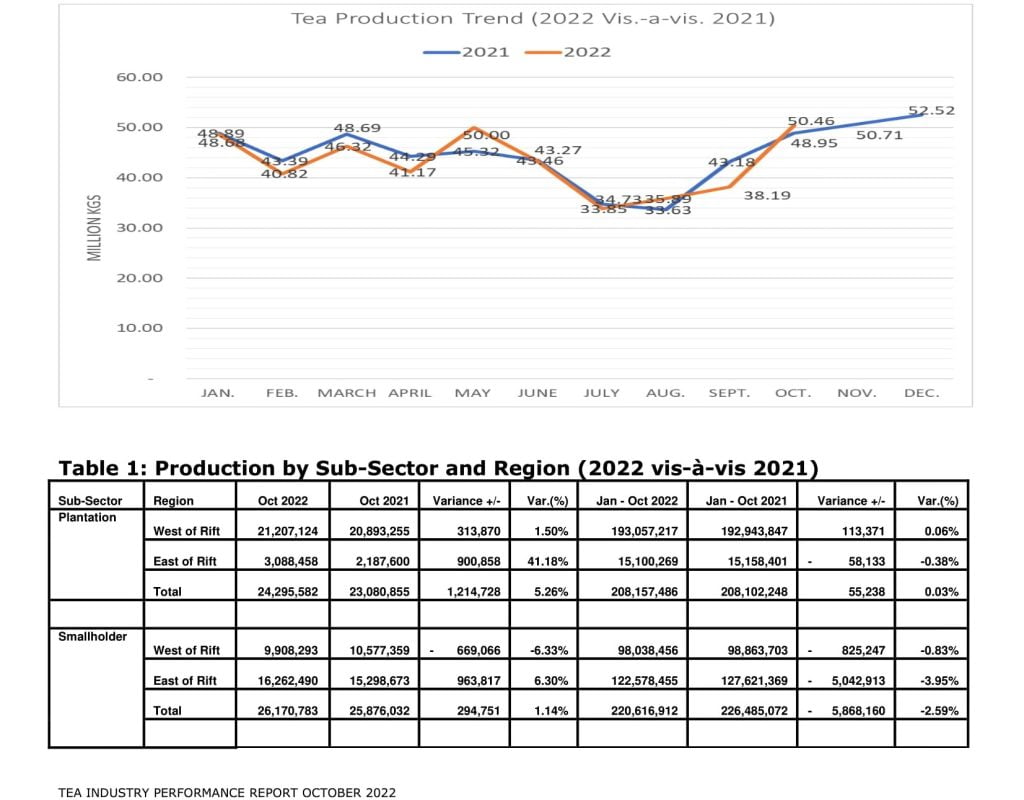

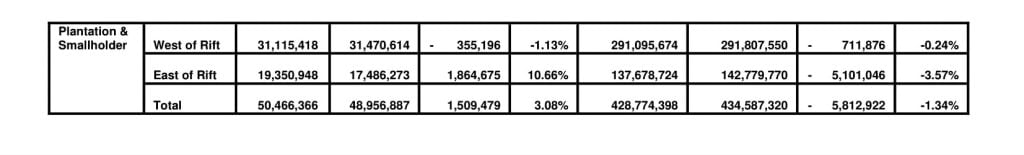

Tea production for the month of October 2022 was slightly higher by 1.5 Million Kgs from 48.95 Million Kgs recorded in the same month of 2021 to 50.46 Million Kgs. Compared to the preceding months of the year, production for the month of October was also much more enhanced from 38.19 Million Kgs recorded in September and 35.89 Million Kgs recorded in August.

Improved production for the month follows the commencement of “Short Rains” Season (October-November-December) subsequent to dry weather conditions recorded during the previous months. Unlike the previous year, the onset of the “Short Rains” season in October 2022 was prompt over most parts of the country especially in the highlands West of the Rift Valley, Central and South Rift Valley, and the Lake Victoria. In tea growing areas, the rainfall amounts received ranged from low to moderate depending on the region.

In the West of the Rift Valley, tea growing areas within Kericho experienced moderate rainfall averaging 25mm to 59 mm daily while the precipitation amounts in the rest of the regions was low (Nandi-6mm to 48 mm; Bomet-3mm to 32 mm; Kisii/Nyamira less than 29mm). Within the East of Rift, most of the tea growing areas received low rainfall averaging less than 9mm daily coupled with alternate dry weather conditions. Notably, since rainfall amounts and distribution within most of the tea growing areas in West of Rift Valley was comparable to the same period of the previous year, production within the region was steady at about 31.1 Million Kgs compared to 31.4 Million Kgs recorded during the month of October 2021.

However, within the East of Rift, production was significantly higher at 19.35 Million Kgs compared to 17.48 Million Kgs recorded during the corresponding month of 2021 owing to timely commencement of the “Short Rains” season in the region. Following good weather conditions in the East and West of Rift compared to October 2021, production within the Plantation sub-sector was slightly higher by about 1.21 Million Kgs from 23.08 Million Kgs to 24.29 Million Kgs.

Similarly, the smallholder subsector experienced enhanced production from 25.87 Million Kgs recorded during the corresponding month of 2021 to 26.17 Million Kgs. However, cumulative production for the ten-month period was lower by 5.81 Million Kgs to stand at 428.77 Million Kgs against 434.58 Million Kgs recorded during the corresponding period of 2021. Going by the trend to-October, lower cumulative production is likely to be recorded for the year 2022 as the rainfall recorded during the “Short Rains” season was depressed (below average) and poorly distributed in both time and space according to reports by Kenya Meteorological Department.

TEA SALES AUCTION

During the month of October, auction sales volume for Kenyan tea was slightly higher at 29.46 Million Kgs compared to 28.30 Million Kgs in the previous month of the year and 29.06 Million Kgs recorded in October 2021.

Increased auction sales in October follows improved demand in key markets such as Pakistan and Sudan and resumption of buying activity by Russia and Iran. Consequently, the average auction price for Kenyan tea during the month of October 2022 was slightly higher at 2.46 USD per Kg compared to 2.36 USD per Kg recorded in September and 2.39 USD per Kg in August. It was also higher compared to 1.98 USD and 2.33 USD recorded during the same period of 2021 and 2020, respectively.

For all the teas offered for sale at the auction during the month, “Best” category across CTC leaf and dust grades fetched higher prices especially those that were well sorted grades and had brighter liquors. Notably, there was no Orthodox tea grades on offer at the auction during the month. During the ten-month period of the year, average auction prices for Kenya tea stood at USD 2.49 per Kg, which was significantly higher compared to USD 2.02 for the same period of 2021 and 2020, respectively and USD 2.19 in 2019.

During the ten-month period of 2022, tea offered for sale by the smallholder tea factories fetched an average price of USD 2.71 per Kg for the main grades from an average price of USD 2.35 recorded during the period January to October 2021 and USD 2.22 for the same period of 2020. Though the auction prices have been on an upward trajectory after experiencing a declining trend to a low of 1.75 USD per Kg in July 2021 for the smallholder tea factories occasioned by the effects of COVID-19 Pandemic, the auction prices during the period March-October 2022 slackened due to the effect of global economic shock in most markets brought about by the Russia-Ukraine crisis. Notably, during the period between March and September, exporters of tea to Russia and Iran markets were less active in tea buying at the auction.

EXPORTS

The total export volume for the month of October 2022 was lower by 22% from 41.82 Million Kgs recorded in the same period of 2021 to 33.22 Million Kgs. The export volume was however more or less similar to that of September which was about 34.14 Million Kgs. However, the number of export markets were higher at fifty five (55) compared to forty eight (48) for the same period of 2021 due to enhanced demand in the global markets occasioned by cold weather conditions following the onset of winter season. During the month, Pakistan maintained its position as the leading export destination for Kenyan tea having imported 15.21 Million Kgs compared to 15.80 Million Kgs imported during similar period of 2021. Tea imports by Pakistan from Kenya also recorded improved performance compared to the preceding months of the year and accounted for 46% of the total export volume. Other key export destinations for Kenyan tea were UK (2.70 Million Kgs); Russia (2.40 Million Kgs); Egypt (2.28 Million Kgs); Sudan (2.09 Million Kgs); UAE (1.36 Million Kgs); Jordan (0.786 Million Kgs); Yemen (0.554 million Kgs); Saudi Arabia (0.552 Million Kgs); and Afghanistan (0.496 Million Kgs). The top ten export destinations, majority of which are traditional markets for Kenyan tea accounted for 85% of Kenya tea export volume. Apart from Sudan; Jordan; Saudi Arabia; and Afghanistan, all the other traditional markets recorded lower tea imports from Kenya compared to the same period of 2021. Decline was also recorded in other key and emerging markets such as in Poland; Kazakhstan; India; USA; Oman; Turkey, Canada; Sri Lanka; Taiwan and Netherlands as well as in seasonal markets such as Kyrgyzstan; Ukraine; Chad among others. The decline in exports was attributed to the global economic recession that has affected purchasing power in most of the markets. However, a few shipments were recorded in other seasonal and emerging markets such as Djibouti; Romania; Azerbaijan; Chile; Peru; Tajikistan; Burkina Faso; Mauritius; Puerto Rico; Seychelles; Gabon; Mauritania; Niger; Togo; Senegal; Brazil; Italy; and Australia. Cumulative export volume for January to October 2022 was lower by 21% to stand at 370.58 Million Kgs compared to 467.90 Million Kgs for the ten-month period of 2021.

LOCAL TEA SALES

Local tea sales for October 2022 stood at 3.31 Million Kgs against 3.12 Million Kgs for the corresponding period of 2021 while cumulative sales in the local market for the ten months period up to October 2022 was lower at 27.89 Million Kgs against 31.03 Million Kgs for the same period of 2021 and 33.69 Million Kgs for the ten months period of 2020. Less sales during the year to-October was attributed to lower demand of tea due to reduced purchasing power amongst the consumers occasioned by inflationary pressure on commodity prices. The high rate of inflation was brought about by effect of the ongoing global economic recession. Overall inflation rate for the ten month period of 2022 was higher at an average of 7.31 percent compared to 6.18 percent for the same period of 2021 and 5.25 percent in 2020.