Cooperative leaders have been urged to tap into new and lucrative sources of income to grow the sector and boost their resources. The cooperative movement despite controlling close to Kshs 1 trillion worth of assets is yet to exploit endowed, new economic sectors areas such as real estate, retail and even wholesale.

Cooperative Alliance of Kenya (CAK) Chairman Macloud Malonza says that the cooperative movement has continued to register impressive growth while contributing to the large economic growth of the country.

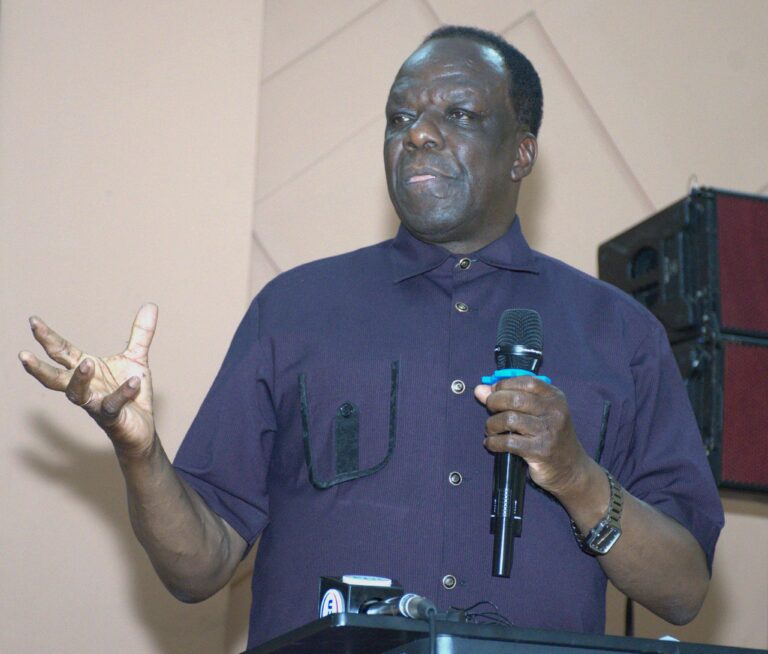

Speaking at a two day workshop organized by the CAK on how the cooperative leaders can align with current tools and also face emerging risks facing businesses today and in the future. The chairman said that primary cooperatives have concentrated to tap their resources from traditional economic sectors like coffee, dairy and tea but have not gone beyond that to discover new avenues.

“Cooperative societies have continued to mobilize more resources and disburse the same in term of loans and although the current scenario paints a very progressive situation and a strong future, cooperatives are still not yet able to tap into other new and lucrative economic sectors to register more growth,” said Mr. Malonza.

The Sacco Societies Regulatory Authority (SASRA), in the Sacco Supervision Annual Report 2023 released this week says that Savings and Credit Cooperative Societies control the largest proportion of the sector’s assets amounting to Kshs 971.96 billion representing 6.43 per cent of the national nominal Gross Domestic Product (GDP).

In the year 2023, 357 regulated SACCOs gross loans grew by 11.50 per cent to reach Kshs 758.57 billion up from Kshs 680.35 billion in 2022, depicting increased demand for their credit services. These loans were mainly funded by savings and deposits mobilized from the membership which increased by 9.95 per cent to reach Kshs 682.19 billion in 2023, thereby cementing the place of regulated SACCOs as critical mobilizers of domestic savings.

Malonza added that the cooperative movement is on course and referred to the new Cooperative bill that is at its second reading and almost being finalized hopefully by October as a catalyst that will be able to change the business model of the SACCOs.

Vincent Marangu, the Director in charge of the Cooperatives Banking Division at the Cooperative Bank of Kenya noted that the cooperatives model contributes in a big way in enhancing financial inclusion. He said by July this year, asset bases under the control of all cooperatives had reached close to Kshs 7 trillion demonstrating the sector’s endowment.

“There are more opportunities that the cooperative movement can pursue to grow their businesses, like property development, retail and wholesale sectors, hospitality industry, transport and health sectors,” said Mr. Marangu.

In the developed world, credit unions control a huge sector of the economy as well as the national savings. Statistics from the state department of Cooperatives indicate that close to 35 per cent of the national savings is under the cooperative societies.

Marangu explained that the cooperatives can grow their credit business by expanding beyond the usual sources such as salaries and other proceeds and fast track other businesses associated with institution members.

“This however requires a high level of business innovation, mind and interaction. For example, as a Sacco Credit Officer go further and ask the teacher, banker, transport officer, manufacturer, or any other worker, what else do you do? If the farmer undertakes dairy farming or poultry farming where are their proceeds deposited to,” opined Marangu.

He gave an example of cooperatives that have been risking investing in housing projects saying it’s important that they know at what level to scale it up and pick up on the project. What we are seeing, he added, is the appetite for large, mega projects. “But we have seen that the most successful investment cooperatives or housing cooperatives are the ones that are able to take smaller projects, that they are sure they are able to offload to their members. Work on a project of 1000 houses, where you have an assurance that 80 percent of your members will take up the project, and you go out there to market the remaining 20,” he said.

The Director encouraged SACCOs, who normally make good money at the end of the year, to think critically about their reserves and how they are building on their capital so that they prepare themselves for difficult times in future saying “If there could be such a time, this is the time now that SACCOs are now empowered to know that they are not competing on dividend payment or interest on deposits but on creating reserves and building their capital for any day in future.”