By Kimuri Mwangi

Cooperative societies have been urged to intensify efforts to strengthen capital retention by expanding credit access to their members. Loan provision in the Sacco subsector currently averages 10–11 per cent, though the Cooperative Bank of Kenya believes institutions can raise this to more than 15 per cent annually.

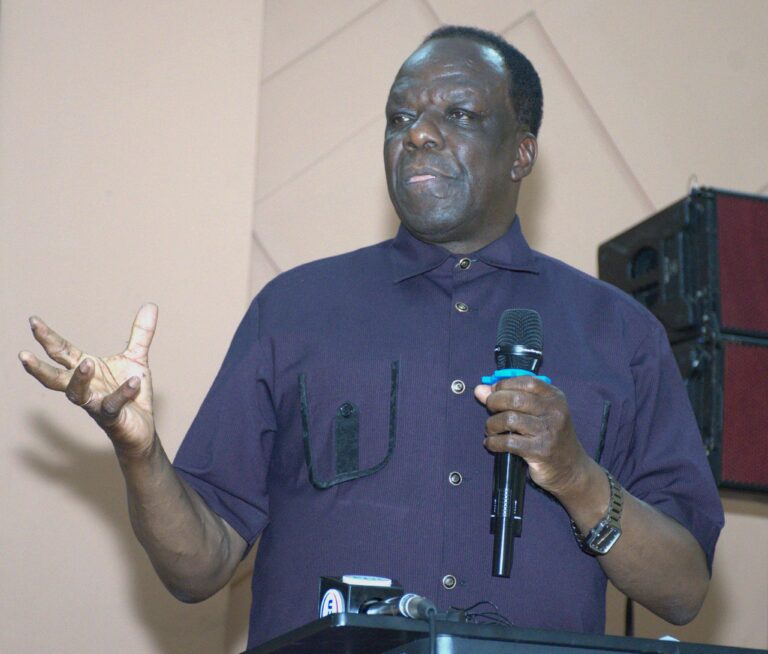

Vincent Marangu, Director-in-Charge of the Cooperative Banking Division at Cooperative Bank, called on credit unions to adopt strategies that boost retained earnings in line with global standards. Speaking during the 4th Annual Cabinet Secretary for Cooperatives and MSMEs Consultative Forum in Naivasha, he noted that Saccos generate between five and six per cent of their gross earnings.

“When we look at our SACCO sub-sector, one of the things we are challenging ourselves is how do we expand affordable credit to our members? And though the role is done well, we are seeing loan growth in the sector just averaging 10 to 11 per cent year in year out. This should not be adequate, but we should strive to move to heights of 15 per cent,” he said.

Marangu cited the World Cooperative Monitor (WCM) Report 2025, released by the International Cooperative Alliance (ICA) and the European Research Institute on Cooperative and Social Enterprises (EURICSE), as a wake-up call, noting that none of the 300 leading cooperatives featured in the global turnover rankings are from Africa. The report shows the top 300 cooperatives and mutuals recorded a combined turnover of USD 2.79 trillion in 2023, dominated by agriculture (35.7 per cent), insurance (31.7 per cent), and wholesale/retail (18 per cent).

He said Kenya’s cooperative movement must scale up investments to unlock its potential. Although Kenya ranks first in Africa and seventh globally in deposits and membership, financial cooperatives still trail their counterparts in Europe and the United States.

“This means consolidating businesses such as housing, dairy, agriculture, transport, hardware, and real estate. Equally, this can be achieved through creating great entities that can endure global cutthroat competition and further enhance product innovation,” he added.

The Cooperative Bank of Kenya was ranked ninth globally among cooperative financial institutions based on high turnover relative to GDP per capita. In 2023, the bank posted USD 217,873 in banking income per GDP per capita. France’s Groupe Crédit Agricole led the category with USD 870,851, followed by Germany’s Cooperative Financial Network (BVR) at USD 727,318.

“Our bank, which has been the engine of the cooperative movement in the country since the 1960s, has recorded an exemplary performance owing to a strong and well-steered cooperative movement,” Marangu said.

He further urged financial cooperatives to accelerate strategies aimed at capital retention, particularly by expanding credit access to members.

Cooperative Alliance of Kenya (CAK) CEO Daniel Marube stressed the need for the sector to reflect on challenges hindering growth.

“Kenya’s cooperative sector has made great strides in the world. However, the sector stakeholders need to pursue serious dialogue to address emerging gaps, mainly the lack of affordable credit services, low extension services, and expensive farm inputs,” said Marube.

He attributed the sector’s progress to strong trust and confidence among members. “We have invested greatly in addressing challenges, mainly good governance, affordable financial services, and boosting extension services. The cooperative sector is a key ingredient for growth,” he added.

Marube noted that the three-day forum provides an opportunity for stakeholders to strengthen governance in Saccos. “Our goal is to build strong cooperative institutions through which our members can access affordable financial services, develop the culture of savings, and therefore build wealth through their entrepreneurial activities that they are individually taking,” he said.

The forum, organized by CAK, is themed “Shaping the Future of Co-operatives: Leadership, Innovation, and Sustainable Growth.” CAK represents registered cooperative societies across the country, serving over 14 million Kenyans and mobilizing more than KSh 800 billion in savings, about 30 per cent of national savings.