Uganda has recorded a noticeable decline in coffee prices over the past month, a development the Ministry of Agriculture, Animal Industry and Fisheries attributes to global market dynamics rather than domestic policy.

In a statement issued on June 27, Minister Frank Tumwebaze confirmed that farmgate prices for Robusta (FAQ) currently range between UGX 10,000 and UGX 11,000, while Robusta (Kiboko) is selling for UGX 5,000 to UGX 5,500. Arabica parchment is fetching between UGX 14,000 and UGX 15,000, with Drugar (clean) trading at UGX 14,000.

“These changes reflect a global downturn in coffee prices, driven by increased production in major coffee-growing countries and market volatility,” said Tumwebaze.

The minister noted that the high prices seen over the past two years were largely due to a combination of increased global demand and supply constraints caused by adverse weather events in countries like Brazil and Vietnam. Uganda’s Robusta, in particular, benefited from this trend.

However, recent improvements in weather conditions have led to an expected rebound in Brazil’s coffee harvests. “Brazil’s coffee production is projected to grow by 0.5% to 65 million bags in the 2025/26 season, while Vietnam’s output will increase from 29 million to 31 million bags,” Tumwebaze explained.

This surge in global supply, especially of Robusta, has created an oversupply in the market, putting downward pressure on prices. “Vietnam has recently seen a significant increase in exports, further contributing to the decline,” he added.

Currency volatility, especially involving the US dollar, and speculative trading on global exchanges have also impacted price trends. Coffee is traded on major international exchanges such as the Intercontinental Exchange (ICE) in New York for Arabica and the London International Financial Futures and Options Exchange (LIFFE) for Robusta.

“Coffee prices fluctuate like any other commodity traded on the stock exchange,” Tumwebaze said, citing a June 17 report indicating that ICE coffee futures hit their lowest level since January.

The minister emphasized that the recent dip is not the result of any government action. “It is, therefore, not as a result of any government policy/intervention,” he stated.

According to the USDA’s World Markets and Trade Report for June 2025, global coffee production is forecasted to reach a record 178.7 million bags in 2025/26, up 4.3 million bags from the previous year. World coffee bean exports are also projected to rise by 700,000 bags, offsetting losses from Brazil and Colombia with gains from Vietnam, Ethiopia, and Indonesia.

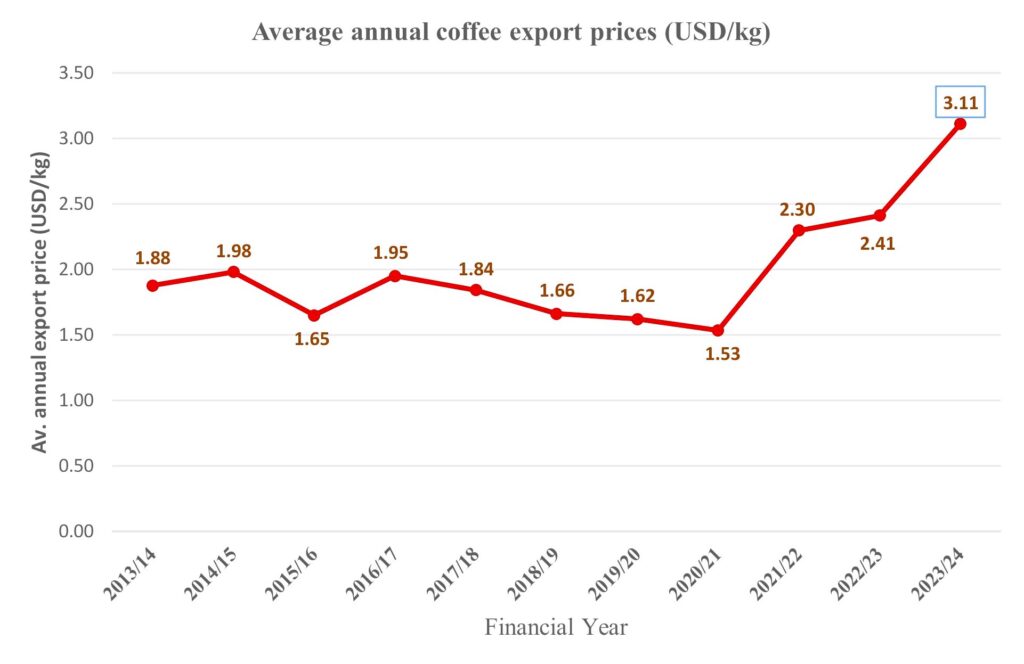

Despite the price slump, Uganda’s coffee export performance remains strong. Between June 2024 and May 2025, the country exported 7.43 million bags worth USD 2.09 billion, marking a 22% increase in volume and a staggering 93.6% rise in value compared to the previous year.

“Our coffee industry is on track,” said Tumwebaze, urging farmers to stay the course. “I call upon all coffee farmers across the country to remain calm, plant more coffee and ensure good quality to compete favorably with major producers such as Brazil and Vietnam, and to add value to maximize earnings from each kilogram sold.”