By Kimuri Mwangi

Kenya’s Sacco sector continued its upward trajectory in 2024, recording a robust 10 per cent growth and pushing total assets to a record KSh1.8 trillion. Members also reaped the benefits of this performance, enjoying an average return of 10 per cent in dividends.

The Commissioner for Co-operatives Development, David Obonyo, emphasized the sector’s financial strength and the security of members’ funds. “The Sacco movement holds around 30 per cent of Kenya’s savings, and I want to assure all Kenyans who have savings in the Saccos that we have an elaborate legal framework, policy and guidelines that ensure that the funds are safe and secure,” assured Obonyo.

Currently, the Sacco loan portfolio stands at more than KSh1.1 trillion, while savings have surpassed KSh1.2 trillion. These figures reflect the continued trust and participation of millions of Kenyans in cooperative financial institutions.

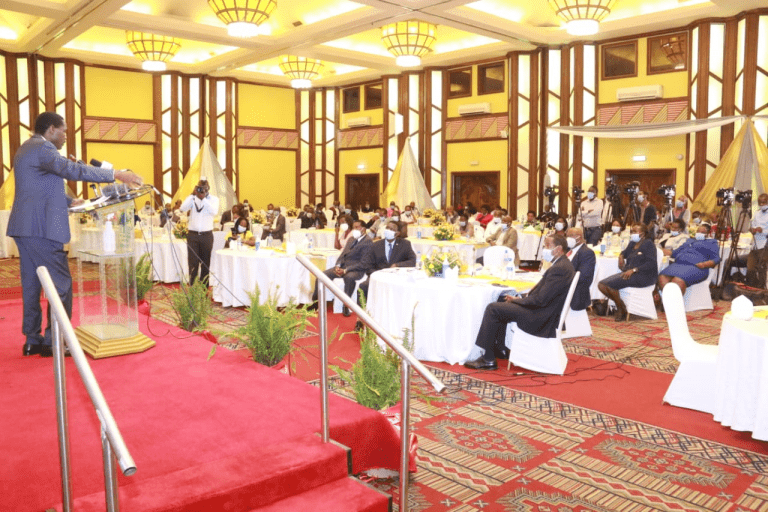

Obonyo spoke during the launch of the pre-Ushirika Day events in Nairobi, organized by the Co-operative Alliance of Kenya (CAK). He pointed to the establishment of the Sacco Societies Regulatory Authority (SASRA) as a key mechanism in ensuring regulatory compliance and safeguarding deposits. “As government, we have established the Sacco Societies Regulatory Authority (SASRA), which undertakes inspection and regulation of Saccos in the country to ensure that the institutions operate within the guidelines in efforts to guarantee the safety of members’ savings,” he said.

He further noted that Saccos in Nairobi had disbursed more than KSh35 billion in interest and dividends to members by February 2025, an indicator of the sector’s stability and profitability.

Looking ahead, Obonyo stressed the need for cooperatives to adopt technology to maintain competitiveness. He revealed that the Ministry has developed a proposal for a central liquidity and shared digital platform. “We want to have a central liquidity and shared platform as part of the legal framework to enable the cooperatives to come together and share technology and lend money to each other,” he opined.

CAK Chairman Macloud Malonza echoed these sentiments, noting that the sector’s growth trajectory called for modernization and legislative support. He expressed support for a proposed bill that would allow Saccos to enter the national payment system and expand their services.

“We want to enhance our financial inclusivity where we can reach out to the marginalized in society, which is in line with our theme for this year’s Ushirika Day celebration, which is ‘Driving Inclusive and Sustainable Solutions for a Better World,” said Malonza.

Malonza also underscored the sector’s investment in ICT and customer-focused research. “We are also conducting capacity building for our Sacco leaders through the African Confederation of Cooperative Savings and Credit Associations (ACCOSCA). Some of our Saccos are growing big and we forecast that in the next three years, we will have some with assets of over KSh100 billion, and therefore we need well-trained managers to oversee the institutions,” he said.

CAK Chief Executive Officer Daniel Marube welcomed the recognition of 2025 by the United Nations as the International Year of Cooperatives, calling it a significant milestone for the movement. He noted that cooperatives have been instrumental in addressing social and economic challenges, particularly in areas like food security, housing, clean water access, and environmental sustainability.

“In preparation for the Ushirika Day this year, we will conduct several activities, including a blood donation drive, a tree-planting exercise, and exhibitions, among other activities,” said Marube.

Marube added that plans were underway to secure 100 acres within Ngong Forest to establish a cooperative forest, primarily composed of fruit trees. “Once we are allocated this parcel of land, we will fence it as the cooperative sector and subdivide it among our Saccos so that they can go in there and grow the trees,” said Marube.

As the Sacco sector continues to expand, the sector leaders remain confident that with strong regulation, technology adoption, and capacity building, Kenyans’ savings will remain not just secure but also increasingly rewarding.