By Kimuri Mwangi

Despite agriculture’s vital role in boosting GDP and alleviating poverty, the sector receives much less funding than other sectors. According to the World Bank, agriculture receives only 3% of global development funding.

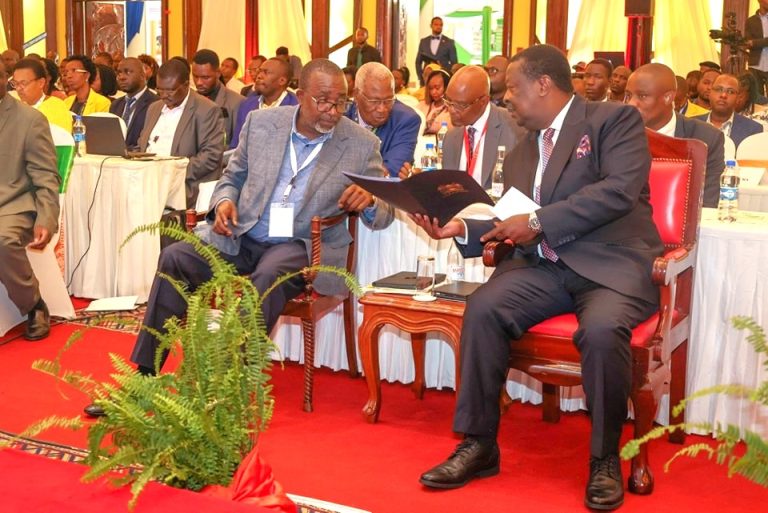

The Kenyan government and other experts focused on in a media launch event for the Financing Agri-Food Systems Sustainably Summit (FINAS 2025).

According to the Ministry of Agriculture and Livestock Development, the sector accounts for about 20 percent of the Gross Domestic Product (GDP) and another 27 percent indirectly through linkages with other sectors in Kenya’s economy. The sector also employs over 40 percent of the total population and more than 70 percent of the rural populace, a trend similar to many other African Countries.

Dr. Charity K. Mutegi, the FINAS Summit Director, said that the diminishing, uncertain external financial support necessitates greater innovation, with leaders leveraging domestic resources to build self-sustaining food systems.

Freddy Bob Jones, the Managing Director at Aceli Africa, opined that the lack of access to finance agriculture is mainly due to the high risks and costs of lending to the sector. “From this perspective, the average yield on a 10-year government bond is about 14%, whilst, according to research and data collected by Aceli, the average return on agricultural loans for a commercial bank is around 3%. As a result, the sector has historically received only 4 to 5% of commercial bank capital.” He added that by working with 45 banks, non-bank financial institutions and impact investors, they have provided loans to agri-SMEs, thereby creating market access and employment for over 1.5 million smallholder farmers and workers through them.

The Principal Secretary in the Ministry of Agriculture and Livestock development Dr Kipronoh Ronoh who was the Chief Guest said that in the current fiscal year 2025/26, the total allocation for the agriculture sector is Kshs 77.7 billion, up from Kshs 73.9 billion in the previous fiscal year with the allocation representing 3.0% of the Ministerial share indicating that the government was increasing the agriculture budgetary allocation

Under the theme “Taking Ownership: Rethinking Sustainable Financing for Africa’s Food Systems,” the FINAS 2025 Summit, which will be held on 20- 22nd May 2025 in Nairobi, will serve as a critical platform to explore, unlock and revolutionize sustainable financing solutions to secure Africa’s food future. This shall be achieved by uniting global leaders, policymakers, innovators, financiers and food systems actors and key stakeholders.

“FINAS 2025 comes at a critical moment when digital transformation is creating unprecedented opportunities to reimagine agricultural financing. Thought leadership initiatives such as FINAS Summit, which focuses the conversation on the food systems transformation agenda and provides a platform for stakeholders to propose sustainable solutions for financing agri-food systems in Africa, are crucial. The future of food systems transformation hinges on the ability of African governments to create homegrown solutions that do not hinge on foreign aid as the silver bullet,” said Dr. Charity K. Mutegi, the FINAS Summit Director.

“As the co-lead of the Innovation, Data and Technology focus area, the Fintech Association of Kenya (FINTAK) will drive forward critical conversations on leveraging digital innovation to transform agricultural financing across Africa. This pivotal role recognizes Kenya’s leadership in fintech innovation and FINTAK’s commitment to applying technological solutions to pressing development challenges. Agricultural financing represents one of the most significant opportunities for fintech innovation in Africa,” said George Abwajo, Board Member FINTAK.

The Principal Secretary in the Ministry of Agriculture and Livestock Development, Dr Kipronoh Ronoh, added that the upcoming FINAS summit provides a platform and an opportunity to explore innovative financial solutions and pathways to securing the growth and sustainability for agri-food systems on the continent. It holds the promise of shaping the future of food systems transformation across Africa.

“As we are all aware, the global funding landscape is shifting, with a significant reduction in support for critical sectors. The agricultural sector is one of those that have been significantly affected by the policy shift from our development partners. This reality compels us to rethink our existing financing and investment models,” he quipped.

The FINAS will focus on four main areas, namely, Inclusive Food Systems Policy, The Youth A-Gender, Funding Resilience, Climate Mitigation and Adaptation, as well as Innovation, Data, and Technology. The focus area on Inclusive Food Systems Policy will be highlighting Kenya’s domestication of the Kampala Declaration as a case study and showcasing the progress in repurposing fertilizer subsidy models. Discussions at the summit will explore the public sector’s pivotal role in enhancing agri-food finance, the application of blended finance approaches, and an overview of regulatory frameworks to strengthen agricultural financing.

The Youth A-Gender will spotlight tailored financial instruments for youth and women, initiatives to boost SME financial literacy, and strategies for banking the unbanked, with the co-operative movement as a key driver. On Funding Resilience, Climate Mitigation and Adaptation, the Summit will be addressing the critical need for de-risking food system actors and investments while sealing the leaking pipeline for smallholder farmers, advancing biodiversity, and defining a green finance taxonomy. Innovation, Data, and Technology will feature the scaling of financial access and last-mile delivery through digital innovation, while driving technology adoption, leveraging data, and exploring future directions to bolster food system processes.