- Kshs. 3.4 billion was allocated for expanded community household irrigation while Kshs. 3 billion was set aside to subsidize the supply of farm inputs through the e-voucher system to reach 200,000 small scale farmers.

- Kshs. 850 million will be used to cater for rehabilitation of wells, water pans and underground tanks in Arid and Semi-arid Lands (ASAL) areas using local labour.

- Tree nursery operators are also set to benefit as the government plans to use Kshs. 540 million to enhance tree planting programme across the country using locally sourced seedlings.

- Kshs. 1.5 billion will be used to assist flower and horticultural farmers to access international markets during this period when we are experiencing low cargo traffic in and out of the country due to the Covid19 pandemic.

- Flood control also got Kshs. 1 billion to support flood control measures using local labour in the most affected areas.

- Kshs 82.7b to support environment and water conservation

- Kshs. 52.8 billion for food and nutritional security

- Kshs. 42.6 Billion geared towards the water and sewerage infrastructure.

- Kshs. 10.9 Billion for the management of water resources

- Kshs. 8.6 Billion to support water storage.

- I have set aside Kshs. 52.8 Billion for food security

- Maize or corn seeds exempted from tax to make them available to farmers

Highlights of budget allocations in the agriculture sector

- Tags: Budget Proposals

Share your views about this story

Related stories

East Africa Rises in Global Coffee Trade as Uganda Leads Export Boom

June 30, 2025

No Comments

By Kimuri Mwangi East Africa’s coffee industry is experiencing a moment of historic transformation, led

Low-Carbon Tea Certification Could Double Kenya’s Export Earnings

June 27, 2025

No Comments

Kenya is on track to become the first African nation to certify its tea as

COMESA Plots Path to Integrated Horticultural Market Through Trade Barriers Harmonization

June 25, 2025

No Comments

By Kimuri Mwangi Non‑Tariff Barriers (NTBs) are the hidden forces that delay trucks, inflate costs,

Kenya bans 77 pestcides as it restricts 202 others

June 24, 2025

No Comments

The Ministry of Agriculture and Livestock Development has announced the withdrawal of 77 pesticide products

Coffee seeds & seedlings in high demand

June 23, 2025

No Comments

By Henry Kinyua Data from the Coffee Research Institute reveals a remarkable surge in demand

Kenya FY 2025/26 Budget Allocations for Agriculture

June 18, 2025

No Comments

The Cabinet Secretary for the National Treasury and Economic Planning, John Mbadi, unveiled a Sh4.29

Why Cooking Oil Remains Costly Across East and Southern Africa

June 17, 2025

No Comments

By Kimuri Mwangi Study finds market concentration, cross-border dominance, and weak competition regulation behind high

KALRO Hosts Inaugural Socio-Economics and Policy Development Conference and Exhibition to Strengthen Agricultural Research Impact

June 17, 2025

No Comments

By Kimuri Mwangi The Kenya Agricultural and Livestock Research Organization (KALRO) held its 1st Socio-Economics

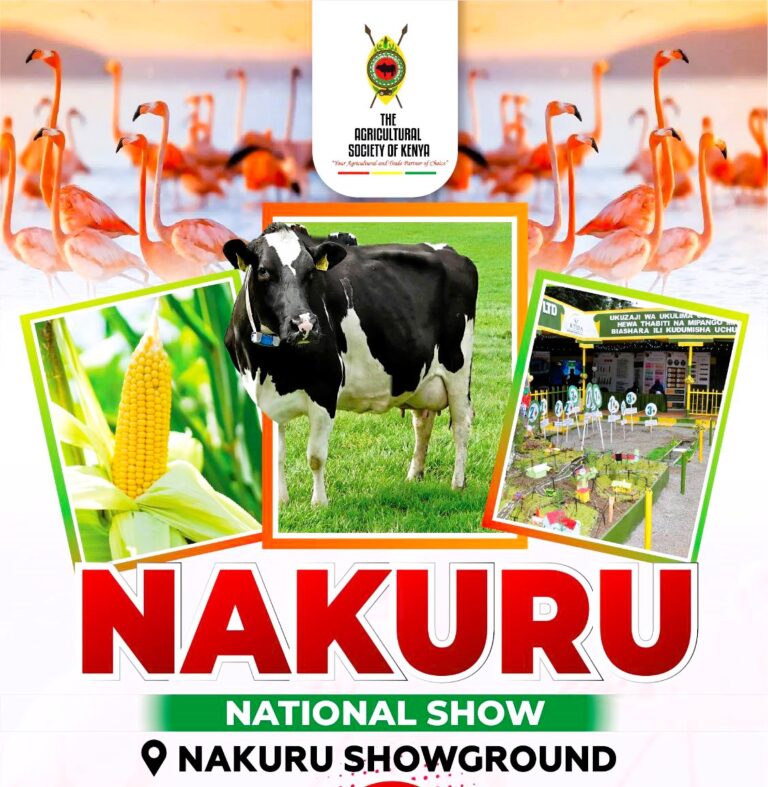

Nakuru ASK Show Introduces Livestock Auctions

June 17, 2025

No Comments

By Suleiman Mbatiah For the first time in its over century-long history, the Nakuru National

Nandi County Mp drawing thousands of women into coffee ownership

June 16, 2025

No Comments

A women-led coffee farming initiative launched by Nandi Woman Representative Cynthia Muge is transforming the