By Henry Kinyua

The 2024/2025 coffee season’s Sale 23 concluded yesterday, March 18th, 2025, at the esteemed Nairobi Coffee Exchange, bringing exciting developments for coffee stakeholders. Trading occurred at the physical exchange on Wakulima House’s 2nd floor along Haile Selassie Avenue and across digital platforms, demonstrating the market’s continued evolution towards hybrid trading.

![]() Market Snapshot

Market Snapshot

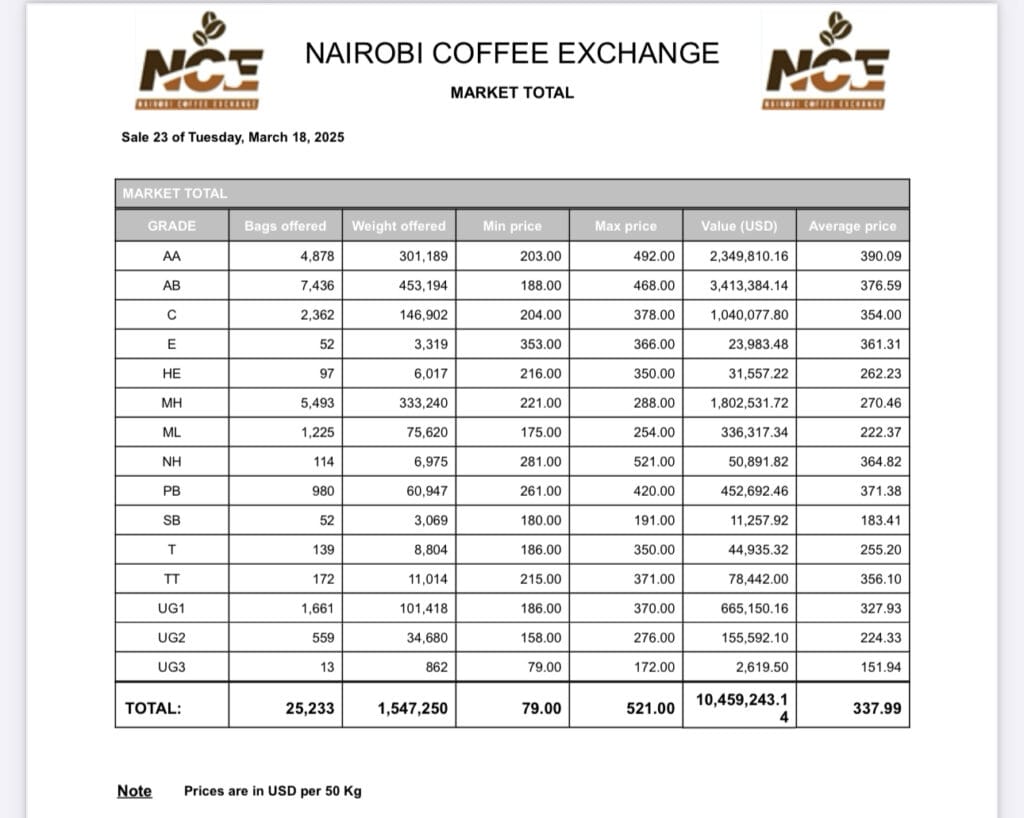

A robust offering of 25,233 bags (50 kg each) changed hands, with average prices settling at USD 337 per bag—a slight adjustment from the previous sale’s USD 342. For producers and stakeholders, this translates to:

• $6.7 per kilogram of clean coffee

• Kshs 134 per kilogram of cherry gross

• Approximately Kshs 107 per kilogram directly to the farmer

Record-Breaking Premium Achievement

JUNGLE ESTATE (Code: AG.0008) from NYERI County shattered expectations with two exceptional lots:

• 17 bags (1,073 kgs) of NH (Natural Heavy) grade securing USD 521 per 50 kg bag

• 22 bags (1,386 kgs) of NH grade commanding an impressive USD 517 per 50 kg bag

This premium performance significantly outpaced Sale 22’s top price of USD 459, showcasing the exceptional quality emerging from Kenya’s renowned coffee regions.

Sale 23 By Numbers

• Total Volume: 25,233 bags (1,547,514 kg) of premium Kenyan coffee

• Market Value: An impressive $10,461,102 (Ksh 1.3 billion) in total transactions

• Premium Quality: 2,819 bags (11% of all traded coffee) commanded USD 400+ per bag

• Grade Excellence: Premium AA and AB grades dominated with 12,314 bags, representing 49% of all coffee traded

Leading Market Players

Broker Leadership

Alliance Berries captured the highest volume, followed by Kirinyaga Slopes, New KPCU, KCCE-MA, and Minnesota Marketers, demonstrating diverse representation across Kenya’s coffee landscape.

Other participating brokers included CEBBA, Kipkelion, Murang’a Union, Baringo Kawa, and United Eastern Kenya.

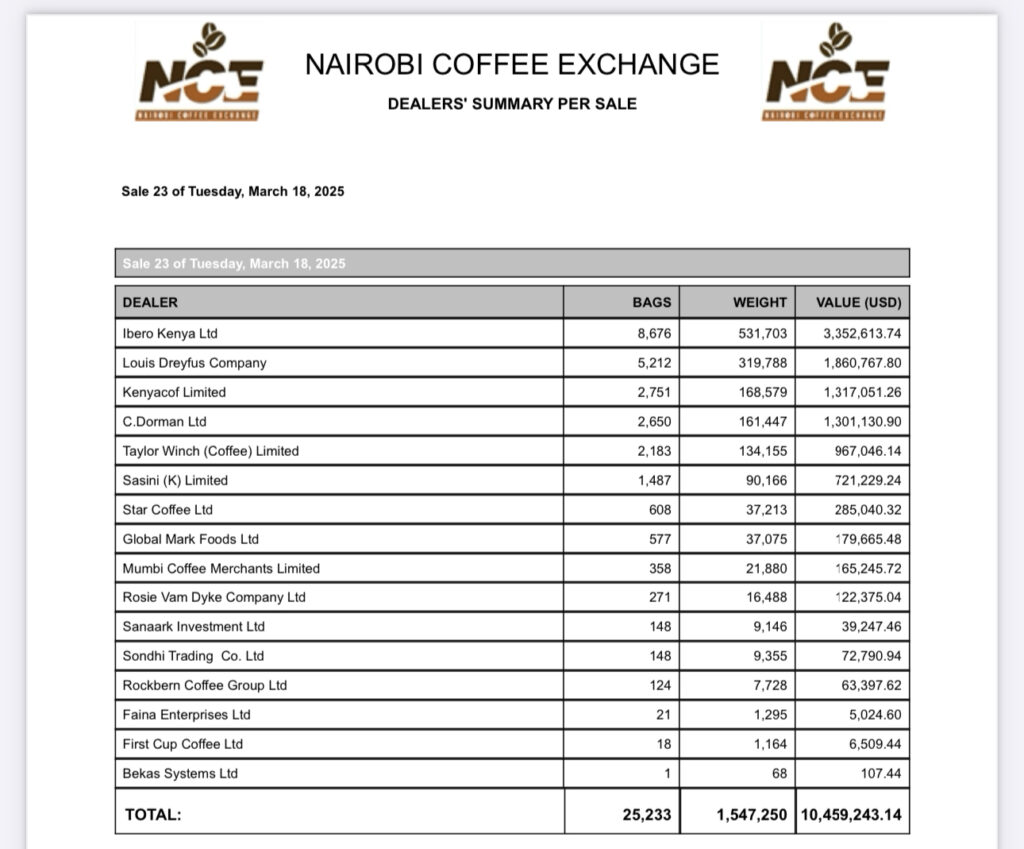

Buyer Dominance

From a competitive field of 16 active buyers, the top performers were:

1. Ibero Kenya Ltd: Securing 27.7% market share with 6,800 bags valued at $2.9 million

2. Louis Dreyfus Company: Close behind with a 24.9% share (6,300 bags at $2.6 million)

3. Kenyacof Limited: Claiming 12.4% with 2,900 bags worth $1.3 million

4. Taylor Winch Coffee: Representing 10.5% with 2,800 bags at $1.1 million

5. C.Dorman Ltd: Completing the top five with a 9.1% share (2,100 bags at $950,000)

In summary, the reduction of volumes and the increase of Mbuni (MH) Grades from Coffees from Nyeri, Murang’a and Kiambu is an indication that most if not all of their main season coffee have been sold and we expect farmers’ payment to happen anytime from now, latest mid-April.

Stay Informed

For comprehensive factory-specific data, watch for the Final Transaction Listing at the end of this week. Coffee stakeholders can access complete historical data through the Kilimo News App, available on Google Play Store or use the web version at https://app.kilimonews.co.ke/index.php/site/index

HK-Tracking Kenya’s coffee excellence, one auction at a time!