By Henry Kinyua

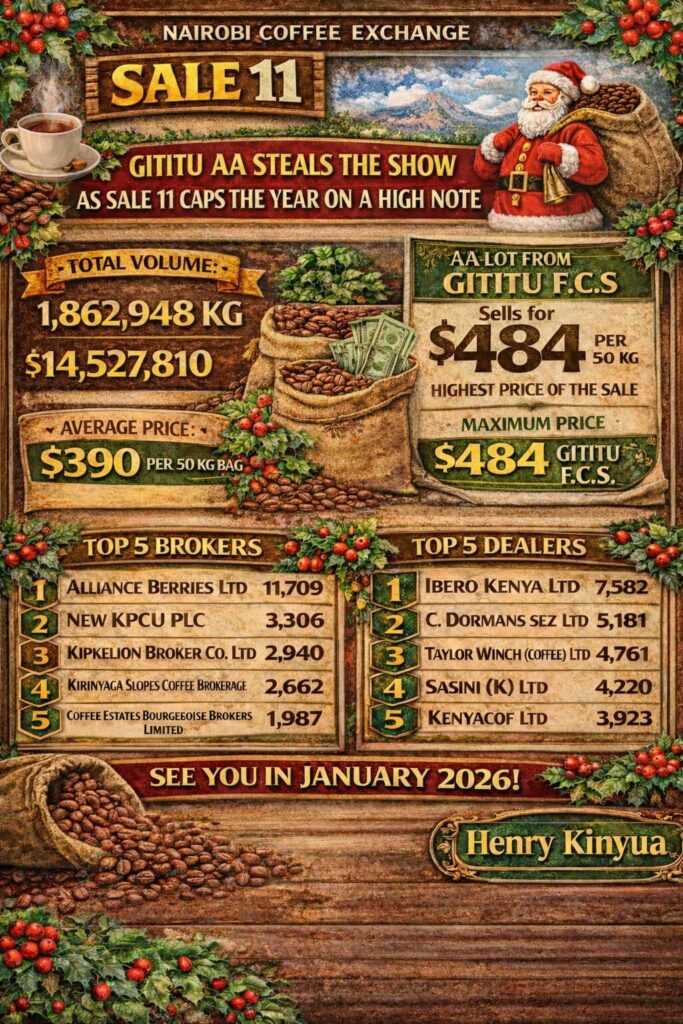

The Nairobi Coffee Exchange (NCE) wrapped up its final auction before the Christmas recess on a confident and upbeat note, as Sale 11 delivered strong volumes, firm prices, and a standout premium lot that underscored the resilience of Kenya’s coffee market heading into 2026.

A total of 30,374 bags, equivalent to about 1.9 million kilograms of clean coffee, were successfully traded during the session, generating a gross market value of USD 14.53 million (approximately Ksh 1.9 billion). The market settled at an average price of USD 390 per 50-kg bag, translating to roughly Ksh 155 per kilogram of cherry, a level that reflects steady demand despite the seasonal close.

The highlight of the day came from Gititu Farmers Co-operative Society in Kiambu County, whose 44-bag AA lot achieved the highest price of the session at USD 484 per bag. Presented by Alliance Berries Limited, the coffee carried both Rainforest Alliance and C.A.F.E. Practices certifications and was snapped up by Louis Dreyfus Company. The result reaffirmed global buyers’ appetite for traceable, certified, and high-quality Kenyan coffees.

Broker activity at Sale 11 revealed a clear blend of scale and quality differentiation across the market. Alliance Berries Limited dominated the session, trading 11,709 bags and posting the highest broker average price at USD 413 per bag, supported by a strong AA–AB mix and the day’s top-priced lot.

New Kenya Planters Co-operative Union (New KPCU) PLC followed with 3,306 bags at an average of USD 391, while Kipkelion Broker Company Limited handled 2,940 bags at USD 380. Kirinyaga Slopes Coffee Brokerage Company Limited traded 2,662 bags at a robust USD 396, and Coffee Estates Bourgeoisie Brokers Limited moved 1,987 bags at USD 353, one of the strongest price outcomes among high-volume brokers.

Further contributions came from Mt. Elgon Coffee Marketing Agency with 1,689 bags at USD 379, Kinya Coffee Marketing Agency Limited with 1,520 bags at USD 337, KCCE Marketing Agency Limited with 1,462 bags at USD 386, and Minnesota Coffee Marketers Limited, which cleared 1,368 bags at USD 382.

Additional volumes were presented by United Eastern Kenya Coffee Marketing Company Limited (1,078 bags at USD 344), Murang’a County Coffee Dealers Company Limited (257 bags at USD 377), Bungoma Union Marketing Agency (215 bags at USD 365), Baringo Kawa Brokerage Company Limited (101 bags at USD 367), and Kiambu Coffee Marketing Limited, which rounded out the line-up with 80 bags at an average of USD 294.

On the buying side, exporter participation remained strong and highly concentrated. Ibero Kenya Ltd emerged as the leading buyer, purchasing 7,582 bags valued at USD 3.58 million. It was followed by C. Dormans SEZ Ltd with 5,181 bags worth USD 2.75 million, Taylor Winch (Coffee) Ltd with 4,761 bags valued at USD 2.27 million, Sasini (K) Ltd with 4,220 bags worth USD 2.05 million, and Kenyacof Ltd with 3,923 bags valued at USD 1.83 million. Collectively, these five buyers absorbed 85 per cent of the coffee on offer.

With strong volumes, a resilient market average, and a headline AA price led by Gititu Factory, Sale 11 brought the pre-Christmas trading window to a confident close. Trading at the Nairobi Coffee Exchange resumes on 6 January 2026, with market watchers expecting the new year to open on a similarly firm footing. The strong finish to 2025 sets an optimistic tone for what many hope will be another solid season for Kenya’s coffee sector.

For more details about the performance of any cooperative, broker or dealer, subscribe to the KilimoNews App at