By Kimuri Mwangi

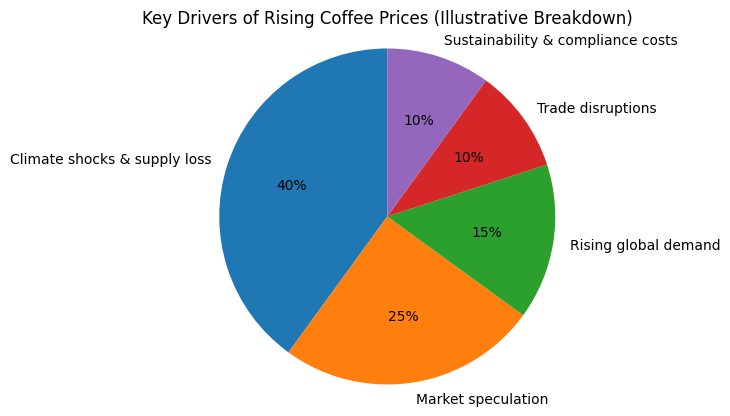

The surge in global coffee prices is not the result of a single shock, but rather a convergence of structural vulnerabilities that are now fully exposed. From Brazil’s coffee heartlands to speciality roasters in Europe, climate disruption, constrained supply, speculative finance, and shifting consumption patterns are reshaping one of the world’s most valuable agricultural commodities.

Brazil, which supplies roughly one-third of the world’s coffee, is at the centre of the current crisis. After three consecutive years of adverse weather, including droughts, heatwaves, and frost, national output has fallen sharply. These conditions have destabilized flowering cycles and reduced bean quality, resulting in lower yields and lighter beans.

In 2024 alone, global coffee supply declined by an estimated 10 million bags, or about 6% of global consumption. The impact has been magnified by coffee’s natural biennial production cycle, in which a strong harvest is often followed by a weaker one. The result has been historically low global stock levels and heightened market sensitivity.

Producers report that weather patterns no longer follow predictable calendars. Rainfall now arrives late or in irregular bursts, while prolonged heat stress damages plants without killing them outright, reducing productivity over time. Even well-managed farms with long-term experience are struggling to adapt.

While supply constraints triggered the price surge, financial markets have amplified it. Coffee has increasingly become a speculative asset on the New York Stock Exchange, traded alongside commodities such as oil and gold. Investment funds have entered aggressively, accelerating price swings and weakening the traditional relationship between supply, demand, and price discovery.

Market participants describe a system where prices can move sharply within hours, often disconnected from physical availability. This volatility has made planning difficult for producers, exporters, and cooperatives alike. Forward contracts, once a risk-management tool, now expose sellers to losses when prices surge after deals are locked in.

Trade policy has added another layer of instability. The imposition of steep U.S. tariffs on Brazilian coffee sharply reduced exports to the American market, redirecting flows toward Europe and reshaping trade routes almost overnight. Such shocks reverberate across logistics, pricing, and inventory management.

Despite record prices, with coffee briefly reaching more than double its value compared to the previous year, many farmers are not benefiting proportionally. Reduced volumes, rising input costs, and quality losses have offset higher prices. Smaller producers, in particular, often sell early to service debt or cover operational expenses, missing later price spikes.

Security concerns have also increased, with higher prices leading to theft and forcing growers to move stock rapidly into cooperative warehouses. Meanwhile, investment in climate adaptation, like irrigation, regenerative agriculture, and improved varieties, requires capital that many producers struggle to access.

On the demand side, consumption continues to rise. China has emerged as the world’s sixth-largest coffee consumer, while Europe has seen sustained growth in speciality coffee. In Spain, for example, coffee prices rose 15% in 2025 alone, yet consumption continued to expand.

Consumers are increasingly seeking higher-quality, traceable, and sustainably produced coffee. This trend has strengthened demand for speciality beans but also raised compliance costs, particularly as new European regulations aimed at preventing deforestation come into force in 2026.

The coffee market is now under pressure from multiple directions. Producers face climate volatility and rising production costs. Exporters confront shrinking inventories and unpredictable pricing. Roasters and retailers absorb increasing costs while trying to maintain affordability for consumers.

At the same time, the market remains highly concentrated. A small number of multinational companies dominate global sales, while speciality coffee continues to grow as a niche segment with higher margins but limited scale.

Industry actors broadly agree that the current volatility is unlikely to disappear quickly. Even if harvests recover, speculative activity and climate instability will continue to shape pricing. Some expect relief within a few years; others warn that the system has entered a new era of uncertainty.

What is clear is that coffee’s price surge reflects deeper structural shifts rather than a temporary imbalance. Climate risk, financialization, and evolving consumption patterns are redefining how value is created and who captures it across the global coffee economy.

For agribusiness stakeholders, adaptability is no longer optional. It is the determining factor in whether producers, traders, and processors can survive in an increasingly volatile market.