By Charles Warria

Cassava ugali and stewed smoked fish is one of my favourite meals. But I eat it cautiously, lest I overeat, given that cassava ugali tends to be heavy, yet pasty. My favourite meal in Ghana is ‘fufu’ (cassava and yam, pounded with palm oil) and fresh tilapia stew. Two portions of fufu, served with stew can last you all day!

Cassava is a vital source of energy. The roots are rich in carbohydrates, primarily in the form of starch, approximately 160 calories per 100 grams of fresh root. Cassava leaves make delicious vegetables and contains up to 25% protein. They are also rich in vitamins A and C, essential for immune function and skin health and provide important minerals including iron, calcium, and magnesium, which contribute to overall health and well-being.

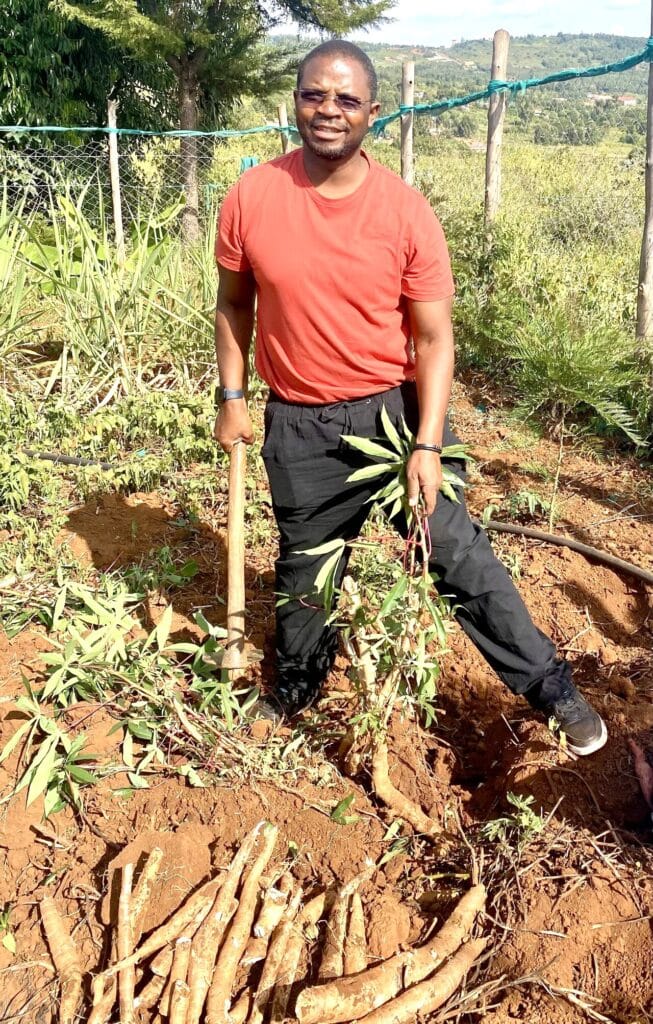

Generally, cassava reaches maturity in 9–24 months or up to 36 months, depending on the variety, climate, and soil conditions. Yields can range from 10 to 30 tonnes per hectare.

Here in Kenya, the cost of producing cassava in Kenya on a small to medium-scale farm is between Kshs 50,000 and Kshs100,000 per hectare. Labour is a major cost factor, especially for manual tasks like harvesting and weeding. The average sale price for fresh cassava is Kshs 15 per kg and 4 kgs of fresh cassava (equal to 3 large tubers) can be processed into 1kg of chips/flour sold at an average of Kshs 50-70.

At current market prices, gross income from cassava farming can range from Kshs 200,000 to Kshs 600,000 per hectare, providing a solid return on investment. With the current local demand of 3 million tonnes annually, Kenya only produces 1.2 million tonnes, with a deficit of 1.8 million tonnes for local consumption. In East Africa, Kenya is the least producer of cassava with Uganda producing 4 million metric tonnes, while Tanzania produces 8 million metric tonnes per year. This is attributed to the lack of clean planting materials, unstructured markets, weak seed systems and weak regulatory framework.

Beyond the Kenyan market, global demand for dried cassava chips has surged in recent years. The cassava industry is projected to grow from USD 207.22 Billion in 2025 to USD 299.62 Billion by 2034.

Here’s some irony though, in 2022, Kenya exported cassava worth USD 1.14 M, making it the 52nd largest exporter of Cassava in the world. In the same year, Kenya imported cassava worth USD 99,500, becoming the 105th largest importer of Cassava in the world.

The global demand for cassava is largely driven by China’s growing need for bio-ethanol production, food products, and animal feed. Chinese manufacturers are willing to order between 50,000 to 100,000 metric tons (MT) of dried cassava chips per month, translating to 1.2 million tonnes per year, with contracts spanning 3 to 5 years. The average price of cassava and cassava products exported to China is around $449.2 per tonne. However, prices can vary depending on the type of cassava, the exporter, and the importer.

Charles Warria is a Market Systems and Private Sector Development Expert.