By Henry Kinyua

For Kenyan coffee farmers, students studying agriculture or agribusiness, and local investors exploring opportunities in the value chain, the Nairobi Coffee Exchange (NCE) provides more than just price updates; it offers a window into how Kenya’s coffee sector is performing.

Week after week, this auction reflects real-time data on how much coffee is being traded and at what price, giving a clear signal of what is happening in the wider market.

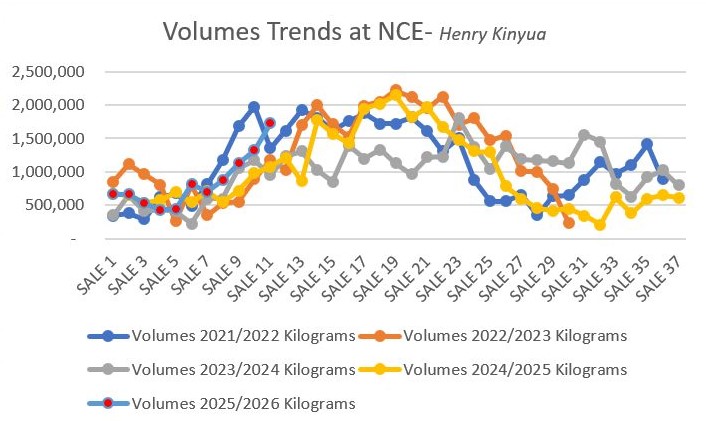

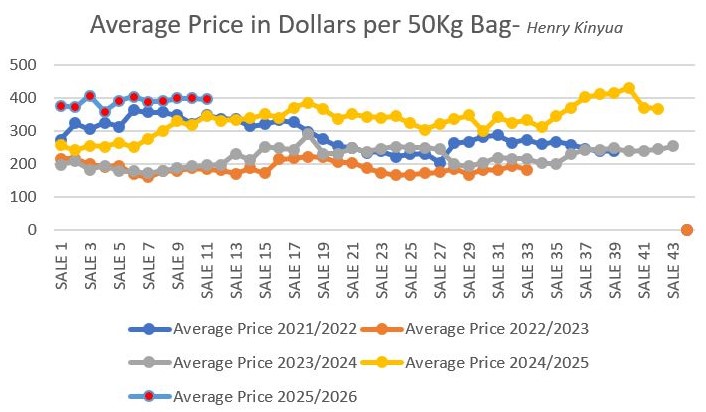

Looking at the last four coffee seasons (2021/2022 to 2024/2025), and early data from the 2025/2026 season up to Sale 11, one trend is clear: Kenya continues to produce steady coffee volumes, and prices have risen sharply, especially since new government regulations were rolled out during the 2023/2024 season.

What Changed in 2023/2024: New Rules for a Stronger Market

In 2023/2024, the Coffee (General) Regulations, 2019 were fully enforced. These new rules strengthened the handling of coffee from the factory to the auction floor. The goal was to improve quality control, formalize auction processes, and increase transparency in grading and payments.

For farmers, this means they now have clearer information on how their coffee is priced and sold. For students, it offers a practical case study of how policy impacts market systems. For investors, this new clarity and accountability reduce risk and opens new opportunities for engagement along the value chain.

A Consistent Supply Pattern Kenyan Farmers Can Work With

Kenya’s supply of coffee to the NCE follows a dependable rhythm each season. The early part of the season (Sales 1–5) features smaller volumes from the fly crop. Between Sales 6 and 8, the volume starts building up, and from Sales 9 to 15, the market sees a surge as the main crop arrives. After that, volumes remain strong mid-season before tapering off.

For farmers, this pattern helps with planning harvests and deliveries. For students, it shows how production cycles link with market activity. For investors, it provides predictable periods when most coffee is available for trade, making planning easier.

How Global Events Affect Kenya’s Coffee Prices

In 2021/2022, frost and drought in Brazil led to a global shortage of Arabica coffee. As a result, Kenya’s NCE saw higher prices, often above USD 300 per 50 kg bag. This shows that when other producing countries face problems, Kenya can benefit if quality and volumes are maintained.

In 2022/2023, Brazil’s coffee production recovered, and global freight issues eased. This led to a drop in prices globally, and Kenya also felt the impact. Despite good volumes, average prices at the NCE fell below USD 220 per bag.

By 2023/2024, things began to shift again. Weather issues in other producing countries and falling global coffee stocks pushed prices back up. At the same time, the 2019 regulations made Kenya’s auction system more credible. This mix of global supply issues and local reforms helped Kenya achieve better prices, even when volumes were not at their highest.

Stronger Prices and What They Mean on the Ground

By the 2024/2025 season, Kenya’s message to the world was loud and clear: we have coffee, and we’re selling it at good prices. Some mid- and late-season auctions recorded over 2 million kilograms of coffee sold, and prices climbed steadily above USD 330 per bag, with some later auctions hitting USD 400.

The start of the 2025/2026 season suggests this trend is continuing. Up to Sale 11, volumes are following the normal seasonal curve, and prices are impressively high, between USD 370 and USD 400 per bag, with Sale 11 averaging around USD 395. Kenya is firmly placed in the premium coffee market.

With Sale 11 of the 2025/2026 season already done, the next few months will be closely watched. If usual patterns hold, strong volumes will continue until around Sale 20. Price movement will depend on global weather patterns and the continued demand for specialty coffee.

Kenya’s overall performance is promising. With strong policies, stable production, and an efficient auction system, the country is demonstrating its ability to maintain high coffee prices. Even though our total production is smaller compared to giants like Brazil or Colombia, our position in the premium segment is secure.

Final Thoughts: Opportunity for Growth in a Changing World

As global coffee markets deal with climate risks and economic uncertainty, Kenya’s coffee season stands out for being stable and open. The Nairobi Coffee Exchange gives a clear and trusted picture of how the market is doing, week after week.

For anyone thinking about the future, whether it’s starting a coffee farm, building a factory, exporting, or creating a Kenyan coffee brand, the message from the market is clear: volumes are up, prices are good, and Kenya continues to be recognized globally for quality. Let’s take this opportunity seriously.